Interest Rate Increases Impact on Property Values

As interest rates increase there is the potential for some declines in property values. Increased lending costs result in less money going to the owner's bottom line.

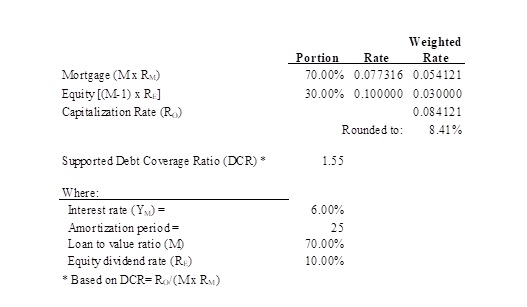

One method of measuring the amount of the potential decline in value is by utilizing the band of investment formula. This formula develops an overall weighted rate by evaluating the fractional rates of mortgage and equity components of an investment. In this analysis we assumed a 25-year loan, 30% equity and a 70% debt.

With a 6% mortgage rate, the derived capitalization rate is 8.41%. When the mortgage increases to 6.25%, the capitalization rate increases to 8.54%, which equates to approximately 1.5% decrease in capitalized value. If the interest rate on a loan would go from 6 to 7%, the decline in capitalized value would be around 6%.

The impact of the decline could theoretically be partially mitigated if the investor is willing to accept a lower return on equity. We saw evidence of this in the past although rates are now very low and it is difficult to see much more compression in rates investors are willing to accept this late in the investment cycle. This analysis also does not factor in the possibility of higher rents which may be prevalent in a more inflationary environment.