(773) 763-6750

< prevnext >

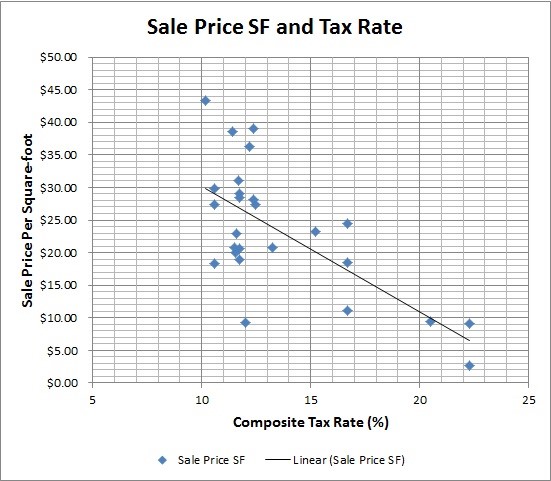

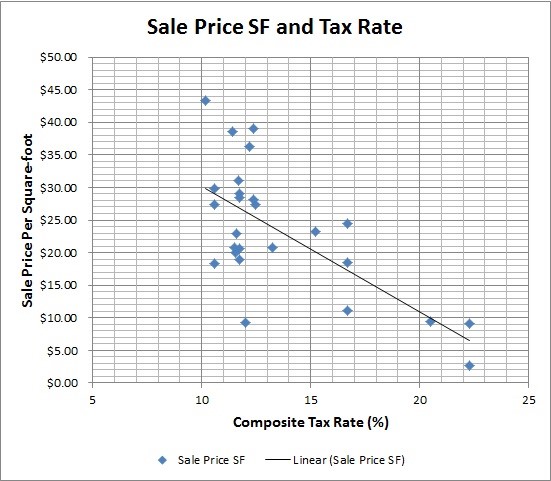

As is clearly evident in the chart, as the property tax rates go up, the value of the properties go way down. Mathematically the effects are as follows:

25% Assessment Level with a 10% Assessment Level with a

1% Increase in the Property Tax Rate 1% Increase in the Property Tax Rate

Property Tax Rate Range Value Reduction Property Tax Rate Range Value Reduction

7-10% -5% 7%-11% -3%

11-17% -4% 12-35% -2%

18-28% -3%

29-35% -2%

In addition to losing value, you can also see the number of sales drop in higher tax communities. That is because buyers want to pay less taxes so they buy in low tax areas. New development is also more likely in low tax areas for the same reason. New development in low tax areas help keep property taxes down creating a virtuous cycle. The opposite occurs in high tax areas where investment leaves and values drop, resulting in even higher property tax rates.

High Property Taxes Hurt Property Values

Most property owners feel the pinch of high property taxes and understand how difficult it can be to keep writing checks to cover these costs. In addition to the annual costs, however, is the very real impact taxes have in suppressing property values. As your taxes go up, the value of your building goes down.We did a small study in 2015 measuring the impact of property tax rates on sales of industrial buildings from 10,000 to 50,000 square feet that were built between 1950 and 1985 in South Cook County. We excluded outliers, REO's and properties with unusually high land-to-building ratios. South Cook County has a dramatically varying tax rates that make direct comparison much easier.

As is clearly evident in the chart, as the property tax rates go up, the value of the properties go way down. Mathematically the effects are as follows:

25% Assessment Level with a 10% Assessment Level with a

1% Increase in the Property Tax Rate 1% Increase in the Property Tax Rate

Property Tax Rate Range Value Reduction Property Tax Rate Range Value Reduction

7-10% -5% 7%-11% -3%

11-17% -4% 12-35% -2%

18-28% -3%

29-35% -2%

In addition to losing value, you can also see the number of sales drop in higher tax communities. That is because buyers want to pay less taxes so they buy in low tax areas. New development is also more likely in low tax areas for the same reason. New development in low tax areas help keep property taxes down creating a virtuous cycle. The opposite occurs in high tax areas where investment leaves and values drop, resulting in even higher property tax rates.