(773) 763-6750

<<< back< prevnext >

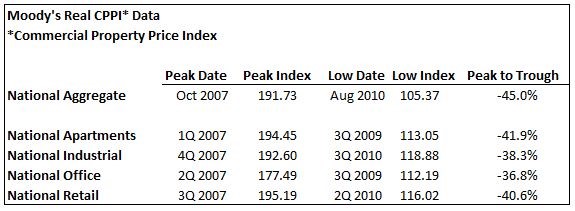

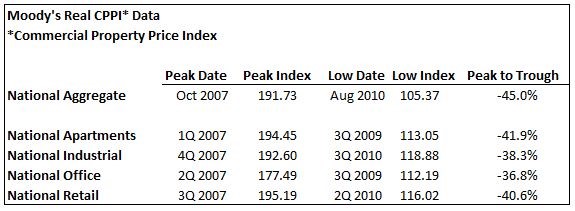

We have taken the underlying CPPI data to calculate peak to trough declines for various commercial real estate property classes. These are presented below. We note that the time between peak and trough varied over the various property classes, with apartments reaching their bottom after just seven quarters, or 21 months; industrial reaching its bottom after eleven quarters or 33 months; office taking ten quarters or 30 months and retail going from peak to trough over eleven quarters or 33 months.

Longer Term Outlook

Multi-Family

Industrial

Office

Retail

Conclusion

Pandemics and Commercial Property Values

The worldwide pandemic of Covid-19, has led to the shutdown and/or curtailment of large portions of the economy in an effort to slow the spread of the disease, which threatens to overwhelm the US health care system. The short-term impacts of the business closures, shelter in place orders and self-quarantines have led to a drastic increase in unemployment and a dramatic decline in economic activity.

There is no certainty on how long the economic impacts will last. The likelihood is that a full return to "normal" economic conditions will not occur until the process of development and distribution of a vaccine is complete, which would give people confidence to resume normal activities. Unfortunately, the vaccine development process has been projected to require at least a year, and possibly more.

Attempting to project the reaction of real-estate market participants in this environment is difficult, to say the least. It seems likely; however, that market participants will look to the most recent severe economic shock as a baseline to anchor their expectations. No matter whether buyers and sellers believe the impacts will be greater or lesser, the recession of 2008 will likely be the yardstick against which the impacts of Covid-19 will be measured.

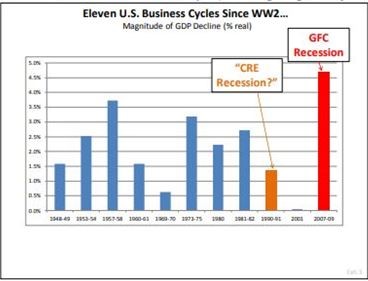

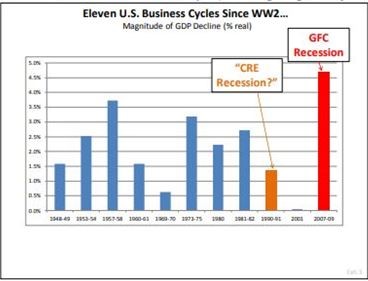

The "great" recession of 2008-2009 resulted in a decline in GDP, from peak to trough of between 4.3%[1] and 4.7%[2], depending on the source and the endpoints selected. John Weinberger, Federal Reserve Bank of Richmond, in the article Effects on the Broader Economy (of the 2008 recession) reports that " US gross domestic product fell by 4.3 percent, making this the deepest recession since World War II. It was also the longest, lasting eighteen months. The unemployment rate more than doubled, from less than 5 percent to 10 percent."[3] In terms of GDP and unemployment the 2008-2009 recession was the most severe since World War II.

[1] John Weinberger, Federal Reserve Bank of Richmond, November 22, 2013

[2] David Geltner, Massachusetts Institute of Technology, Department of Urban Studies & Planning, MIT Center for Real Estate, January 2013

[3] John Weinberger, Federal Reserve Bank of Richmond, November 22, 2013

Currently, in an interview published April 6, 2020, Janet Yellin, former Chairman of the Federal Reserve stated that “If we had a timely unemployment statistic, the unemployment rate probably would be up to 12 or 13% at this point and moving higher," and also she said (second quarter) gross domestic product is "down at least 30% and I’ve seen far higher numbers.”[1] These figures indicate that the severity of the economic downturn is already greater than that of the 2008-2009 recession, and are expected to worsen from here.

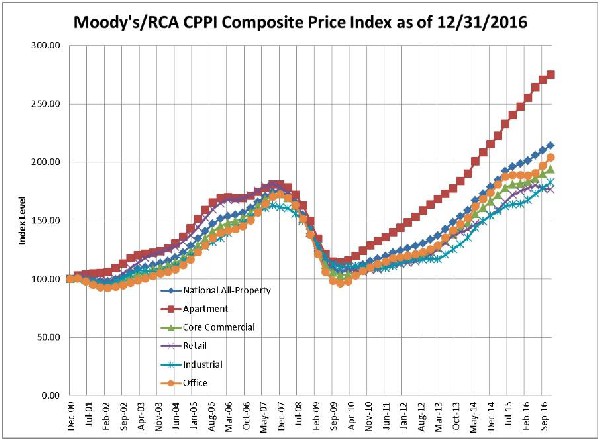

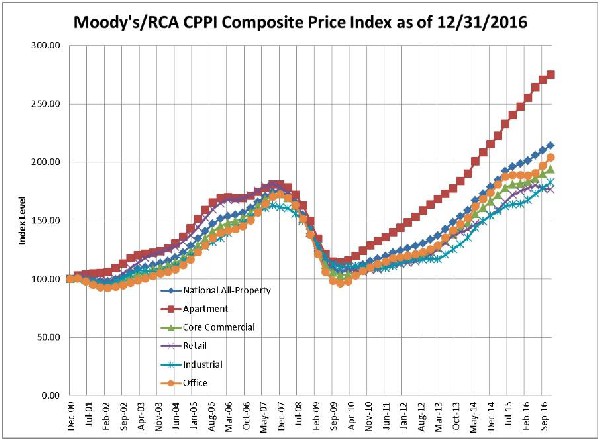

In terms of real estate, the 2008-2009 recession resulted in peak to trough declines in overall real estate values of 45%. Various categories of commercial property value faced declines ranging from 36.8% to 41.9% depending on property class. In this analysis, we have drawn price data from Moody’s/REAL Commercial Property Price Indices or Moody's CPPI.[2] In graphical form, the decline in prices during the 2008-2009 recession is apparent.

[1] Jeff Cox, CNBC interview of Janet Yellen, https://www.cnbc.com/2020/04/06/janet-yellen-says-second-quarter-gdp-could-decline-by-30percent-and-unemployment-is-already-at-12percent-13percent.html.

[2] Moody’s/REAL Commercial Property Price Indices, April 2011, and December 2016 (graph)

We have taken the underlying CPPI data to calculate peak to trough declines for various commercial real estate property classes. These are presented below. We note that the time between peak and trough varied over the various property classes, with apartments reaching their bottom after just seven quarters, or 21 months; industrial reaching its bottom after eleven quarters or 33 months; office taking ten quarters or 30 months and retail going from peak to trough over eleven quarters or 33 months.

The overall real estate market declined by 45% over 34 months. This included housing, which declined more than commercial real estate. That said, total declines of 36% to 42% occurred in CRE, based on property class. In 2008-2009 the declines were spread over two to three years with smaller declines on low sales volume in the initial period, followed by significantly larger declines as sellers capitulated in the face of the continued anticipation of falling values. From their various bottoms, most of the categories of CRE required several years to recover from their bottoms to regain the pre-recession peaks.

The timeline of the Covid-19 economic crisis is very much compressed relative to the 2008-2009 recession. According to the Bureau of Labor Statistics, the unemployment rate in December 2007 was 5% and reached its peak at 10% in October 2009, some 22 months later. The current crisis has eclipsed that increase in as many as days. The drop in GDP during 2008-2009 was between 4.3% and 4.7% from peak to trough, over two years. As noted above, the year to year decline in GDP is anticipated to be greater than the full decline of the 2008-2009 recession by the end of the second quarter of 2020. As the current disruption of the economy is both more severe and more rapid than the recession of 2008-2009, it is reasonable to assume that changes in real estate values resulting from the Covid-19 response will also likely be compressed over a shorter period of time.

Longer Term Outlook

In March 2020, the San Francisco Federal Reserve published a working paper titled Longer-run Economic Consequences of Pandemics. Their conclusions are excerpted here: " Summing up our findings, the great historical pandemics of the last millennium have typically been associated with subsequent low returns to assets, as far as the limited data allow us to conclude. … Measured by deviations in a benchmark economic statistic, the real natural rate of interest, these responses indicate that pandemics are followed by sustained periods—over multiple decades—with depressed investment opportunities, possibly due to excess capital per unit of surviving labor, and/or heightened desires to save, possibly due to an increase in precautionary saving or a rebuilding of depleted wealth."[1]

[1] Jordà, Òscar, Sanjay R. Singh, Alan M. Taylor. 2020. “Longer-Run Economic Consequences of Pandemics,” Federal Reserve Bank of San Francisco Working Paper 2020-09., March 2020.

Various property classes are likely to be affected differently due to the unique nature of the pandemic. It is reasonable to believe that where trends have existed in the relative strengths of one class of CRE over another, those trends are likely to be accelerated. Commercial real estate value declines tend to be like a slow-moving train wreck as many vacancies will not show up for months or years as leases expire and are not renewed. During the early stages of the 2008-2009 recession, a period of very limited sales activity occurred when the spread between asking and offering prices became so large that few transactions took place as sellers and buyers could not come to terms. What sales did occur during that initial period were either deals which were contracted prior, or were by their nature, the result of non-typical motivations during a period of great uncertainty. Once there was general capitulation by sellers, more transactions occurred and prices finally stabilized at significantly lower levels. For certain property classes, particularly office and retail, that scenario is likely to play out again; however, given the compressed time line that this crisis is proceeding along, we should expect prices to adjust to, and stabilize at, lower levels more rapidly than they did during the 2008-2009 recession.

Multi-Family

Apartment properties were the hardest hit in the 2008-2009 recession, and had the most rapid decline from peak to trough. Apartment properties dropped by 41.9% over 22 months. They have also been the strongest class of CRE over the course of the recovery. While in the short term, economic dislocation may make it difficult for tenants to maintain their rent obligations, especially at the lower end of the economic ladder, the underlying need for residential space is not likely to be heavily impacted unless the death toll from the pandemic is much higher than is currently projected. Another factor which remains unknown is whether the desire to live in high-density properties in high-density urban locations will continue after the pandemic has resolved.

Industrial

It currently appears that industrial properties will be somewhat less impacted by the Covid-19 response than other property types. Political pressure is likely to result in bringing manufacturing for critical products back to the US, creating additional demand for manufacturing space. Lower levels of economic activity may result in less product moving through warehouses. The trend towards a product's last stop before the consumer being in a distribution center, rather than a retail outlet, could tend to partially offset that effect, particularly for larger distribution properties. In the 2008-2009 recession industrial property values dropped by 38.3% over a period of 33 months.

Office

In 2008-2009, office property values dropped by 36.8% over 30 months. This was the lowest percentage drop of the four classes; however, the office market was the weakest going into the recession and in many areas vacancy rates remain high to this day. A secular trend towards office work being performed from home was already extant prior to the past recession, and has continued since. The current crisis has a huge fraction of office work being performed remotely from home, even in businesses where it was not formerly common. The new familiarity with this mode of work will likely accelerate the trend towards lower demand for office space resulting in lower rents and lower values.

Retail

Retail properties were also already facing secular headwinds prior to the current crisis as competition from online retailers ate into their business. During the 2008-2009 recession retail properties dropped 40.6% over the course of 33 months. Currently, retail operations, other than grocery or pharmacy and related businesses, are largely shut down across the country. It is likely that a material fraction of these businesses may not outlast the pandemic, particularly if customers are slow to return to old shopping and entertainment patterns. Facing the most severe short-term impacts, on top of an accelerating secular trend against in-person retail shopping, the uncertainty levels for retail property values in general, and restaurants in particular, are greater than for other property classes and the impacts will likely be the most severe in this sector.

Conclusion

The virtual shut down of the economy brings us into uncharted territory. The Federal Reserve and government stimulus package have been far more aggressive than in the prior recession. A pandemic, however, can change behavior and risk tolerance over a much longer-term basis. A huge percentage of the population could require years to get back on their feet after job losses and face uncertain opportunities going forward.

The long-term outlook for commercial real estate values is for lower rates of return than existed prior to the current crisis and there should be no expectation that drops in commercial real estate asset values would be rapidly recovered over a brief period after the pandemic's end. While the timeline of the Covid-19 induced economic crisis is significantly compressed from the 2008-2009 recession, the market will still look to that period to inform their expectations for the current crisis, even if only because the recession is still fresh in people's minds and they know "the playbook." Given the distinct lack of hard evidence at this time (early April 2020) it would appear that the most likely impact of the economic dislocation due to Covid-19 is that the magnitude of the decline in commercial real estate values can be reasonably expected to be similar to the magnitude of declines in the 2008-2009 recession, but are likely to occur over a much more compressed time period.