Retail Space Outlook Will Probably Remain Weak Over the Longer Term

At the most fundamental levels, retail space in the U.S. is in trouble. More than 80% of retail purchases continue to be made through stores or through store-owned retail delivery services per Byron Carlock, head of PwC's U.S. real estate practice as reported in Crain's (11/11/2020). Virtually everyone knows, however, that online sales continue to cut into retail “brick-and-mortar” sales and gain market share with the pandemic only further accelerating this process.

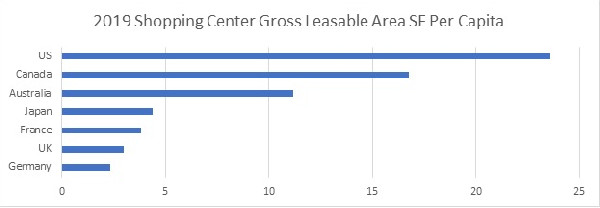

Beyond these market trends lies the elephant in the room - the U.S. retail sector is simply overbuilt. In the U.S., we average 23.59 square-feet of retail space per person versus an average of under 5.0 square feet per person in much of Europe and Japan. Admittedly, these areas have more condensed populations versus the sprawling United States. Two countries that would be more comparable to the U.S. market however, are Canada with an average of 16.77 square-feet per person and Australia with an average of 11.19 square-feet per person. The following chart illustrates the disparity between the U.S. retail market and other nations.

Source: PwC 2017

Carlock predicts the U.S. could begin edging closer to Canada’s 16.0 square-feet per person which would reflect close to an astounding 30% drop in shopping spaces. While we have known for years we are “over-stored,” the sheer economics of today’s environment could finally force a retrenchment. Cook County’s high property tax environment along with the Assessor’s new limitations on accepting vacancy arguments year-after-year could further force the demolition or realignment of many of these properties.

Chicago-area retail sales are projected to drop 10% overall in 2020 per Melaniphy & Associates as reported in a September 20, 2020 Crain’s article. In an over-retailed environment even properties in good locations could suffer. It is hard to imagine how “B” and “C”-located properties could thrive, let alone survive. Look for higher vacancy rates, lower rental rates, lower values, more demolitions and conversion to alternate uses going forward in many locations.