(773) 763-6750

< prevnext >

(This archived article was published in 2013. More recent data is found in the articles section of our web site). Chicago has the largest industrial market in the nation with over 1.3 billion square-feet of space. The Chicago CSMA covers northeast Illinois, northwest Indiana and southeastern Wisconsin. The bulk of the space is situated in the City of Chicago, suburban Cook County and around O'Hare International Airport. Peterson Appraisal Group focuses its industrial appraisal practice in this area. The industrial market has been gradually improving over the past two years. In January 2013 Crain's Chicago Business reported a year-end 2012 vacancy rate of 9.5% (www.chicagorealestatedaily.com), the lowest since mid-2008. A Chicago area commercial appraiser must pay particular attention to occupancy levels which can vary significantly. Peterson Appraisal Group's attention to specific sub-market indicators is one of the reasons the Chicago industrial property class is one of our primary areas of expertise.

(This archived article was published in 2013. More recent data is found in the articles section of our web site). Chicago has the largest industrial market in the nation with over 1.3 billion square-feet of space. The Chicago CSMA covers northeast Illinois, northwest Indiana and southeastern Wisconsin. The bulk of the space is situated in the City of Chicago, suburban Cook County and around O'Hare International Airport. Peterson Appraisal Group focuses its industrial appraisal practice in this area. The industrial market has been gradually improving over the past two years. In January 2013 Crain's Chicago Business reported a year-end 2012 vacancy rate of 9.5% (www.chicagorealestatedaily.com), the lowest since mid-2008. A Chicago area commercial appraiser must pay particular attention to occupancy levels which can vary significantly. Peterson Appraisal Group's attention to specific sub-market indicators is one of the reasons the Chicago industrial property class is one of our primary areas of expertise.

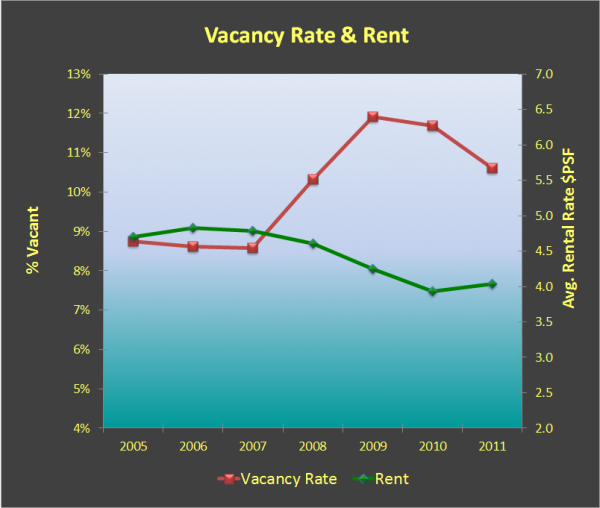

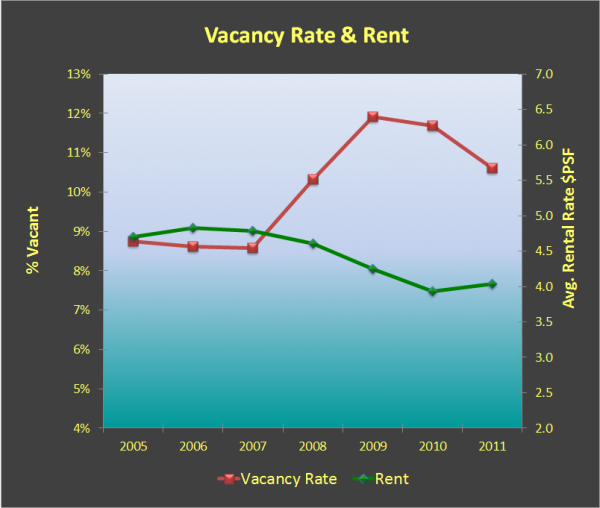

Chicago Area Industrial Rental Rates Industrial lease rates in 2011 show only very slight improvement over 2010.Industrial brokers are reporting fewer leasing concessions being required to attract tenants, however, which is a positive.

Chicago Area Industrial Rental Rates Industrial lease rates in 2011 show only very slight improvement over 2010.Industrial brokers are reporting fewer leasing concessions being required to attract tenants, however, which is a positive.

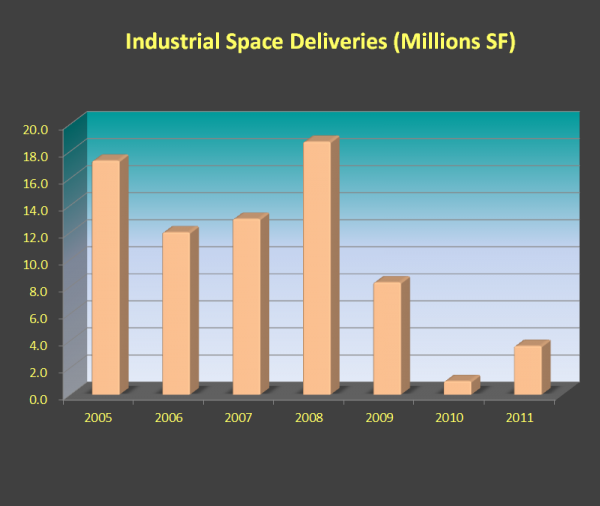

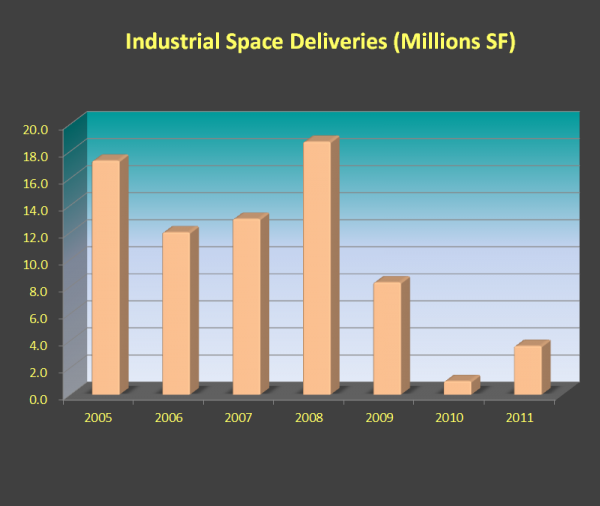

New Industrial Space Deliveries - Chicago Market Area New industrial construction dropped from peak levels of around 19 million square feet in 2008 to only a few million in 2010 and 2011. The dramatic decline in new construction has helped stabilize industrial market vacancy levels. There continues to be very little speculative industrial development with built-to-suit construction dominating current activities.

Chicago Area Industrial Sales Price/Cap Rate Trends Sales of Industrial buildings to the investment community dropped 60% in 2012 from 2011. The average sales price has remained relatively flat at under $50 per square foot. Capitalization rates averaged around 8% benefiting from extremely favorable loan rates.

Chicago Industrial Indicators - Appraisal Statistical Data

Article: (This archived article was published in 2013. More recent data is found in the articles section of our web site). Chicago has the largest industrial market in the nation with over 1.3 billion square-feet of space. The Chicago CSMA covers northeast Illinois, northwest Indiana and southeastern Wisconsin. The bulk of the space is situated in the City of Chicago, suburban Cook County and around O'Hare International Airport. Peterson Appraisal Group focuses its industrial appraisal practice in this area. The industrial market has been gradually improving over the past two years. In January 2013 Crain's Chicago Business reported a year-end 2012 vacancy rate of 9.5% (www.chicagorealestatedaily.com), the lowest since mid-2008. A Chicago area commercial appraiser must pay particular attention to occupancy levels which can vary significantly. Peterson Appraisal Group's attention to specific sub-market indicators is one of the reasons the Chicago industrial property class is one of our primary areas of expertise.

(This archived article was published in 2013. More recent data is found in the articles section of our web site). Chicago has the largest industrial market in the nation with over 1.3 billion square-feet of space. The Chicago CSMA covers northeast Illinois, northwest Indiana and southeastern Wisconsin. The bulk of the space is situated in the City of Chicago, suburban Cook County and around O'Hare International Airport. Peterson Appraisal Group focuses its industrial appraisal practice in this area. The industrial market has been gradually improving over the past two years. In January 2013 Crain's Chicago Business reported a year-end 2012 vacancy rate of 9.5% (www.chicagorealestatedaily.com), the lowest since mid-2008. A Chicago area commercial appraiser must pay particular attention to occupancy levels which can vary significantly. Peterson Appraisal Group's attention to specific sub-market indicators is one of the reasons the Chicago industrial property class is one of our primary areas of expertise.| Submarket | Total Inventory | Vacancy Rate |

| Central DuPage County | 84,175,674 | 9.89% |

| Chicago North | 90,342,780 | 7.16% |

| Chicago South | 84,587,011 | 14.44% |

| DeKalb County | 19,981,307 | 3.09% |

| Elgin I-90 Corridor | 28,273,823 | 12.01% |

| Far South Suburbs | 45,082,832 | 7.03% |

| Fox Valley | 89,389,701 | 9.17% |

| I-290 North | 76,206,830 | 12.91% |

| I-290 South | 45,244,723 | 7.93% |

| I-39 Corridor | 17,452,555 | 6.80% |

| I-55 Corridor | 73,022,765 | 11.88% |

| I-80/Joliet Corridor | 68,002,826 | 13.30% |

| Lake County | 70,162,219 | 11.15% |

| McHenry County | 30,099,848 | 13.36% |

| North Suburbs | 57,639,498 | 9.25% |

| Northwest Suburbs | 34,151,763 | 10.06% |

| O'Hare | 139,976,695 | 10.06% |

| South Suburbs | 102,024,523 | 10.32% |

| Metro Chicago Total | 1,155,817,373 | 10.38% |

| Northwest Indiana | 54,230,618 | 8.03% |

| Rockford Area | 51,574,970 | 10.84% |

| Southeastern Wisconsin | 47,731,500 | 6.62% |

| GRAND TOTAL | 1,309,354,461 | 10.16% |

Source: Colliers International Chicago Industrial Market Overview (Year-End 2011)

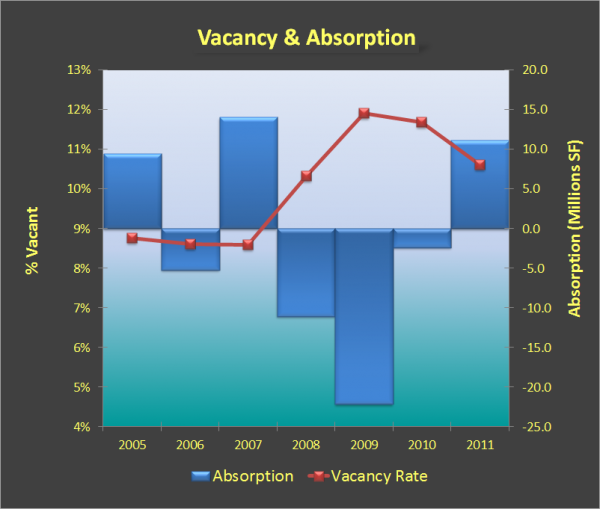

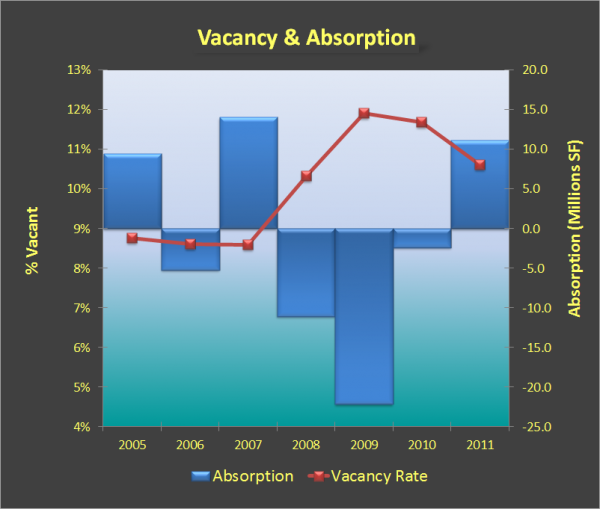

Vacancy & Absorption - Chicago Area

Strong negative absorption rates in 2008, 2009 and more modest declines in 2010 were finally reversed in 2011. The industrial inventory of vacant space declined to 133 million square feet at year end 2011 from 159 million in 2009. Flex space continues to struggle with negative absorption but warehousing demand (almost 5 times greater than manufacturing demand) led the way to a strengthening of the market.