Alsip Value Trap

Article:

Are industrial property prices in Alsip inflated? We think so. This could mislead the tax representative, or appraiser, seeking equitable industrial property valuation in the southwest suburbs. We’ll explain why.

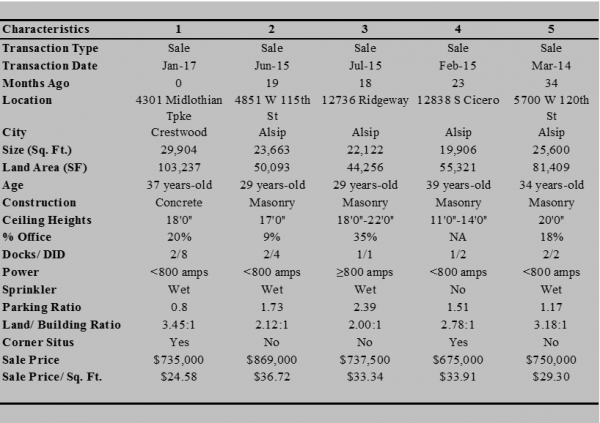

We recently completed an appraisal of an industrial building in the Crestwood/ Alsip area, and were puzzled as to why the purchase price of one recent sale comparable in Crestwood, was so much lower than proximal industrial building comparables in Alsip of similar size, age and utility. Crestwood also has lower property tax rates, so that all else equal, one would expect a higher price per square-foot, not lower.

Alsip’s improved industrial base at 13 million square-feet is almost 13 times the size of Crestwood’s. In appraising an industrial building in Crestwood, it is a virtual impossibility not to use at least some comparable sales from Alsip due to its proximity and the overwhelming size of its industrial base.

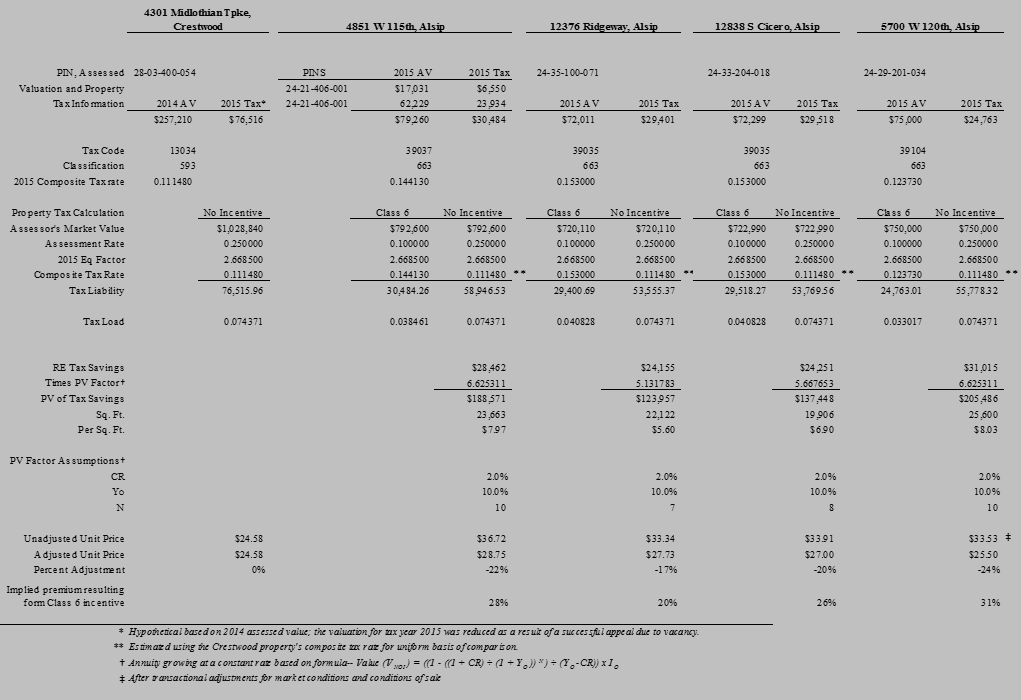

In the following evaluation of the potential differential in the real property tax liabilities of the Crestwood and Alsip properties, we show a premium of approximately 20% to 30% would result from the Class B incentive, using fairly conservative discounting and real estate tax growth assumptions. (This compares the Alsip sales to a sale in a Crestwood district having an 11.148% composite tax rate. For Crestwood properties in a district with a 12.955% composite tax rate, the premium would be even greater).

In appraising an industrial property in Crestwood, or other nearby communities, the valuer inevitably encounters potential comparable sales from Alsip, due to the size of Alsip’s industrial base, and the preponderance of Class 6 properties, which as noted, find more favor in the market. If not cognizant of the profound effect Class 6 status has on marketability and value, one risks significantly over appraising a property without the incentive by inadvertently relying on skewed data. In the example illustrated here, a property having a true value in the mid-to-upper $20 per square-foot range could easily be valued in the low-to-mid $30 per square-foot range, with no one the wiser.