Religious Market Highlights 2018

The commercial real estate market in greater Chicago area reached a bottom in 2012 in the aftermath of the recession. This 2018 edition of Religious Market Highlights reviews market trends over the 5-year period following 2012.Chicago Area Religious Facility Market Trends

2017 | Averages | ||||||||

2013 | 2014 | 2015 | 2016 | 2017 | % Chg | 3-year | 5-year | 9-year | |

Transactions | 26 | 30 | 34 | 35 | 22 | -37% | 30 | 29 | 25 |

Total Dollar Volume (000s) | $17,437.2 | $18,410.8 | $22,179.0 | $40,862.4 | $13,685.7 | -67% | $25,575.7 | $22,515.0 | $20,185.0 |

Square Footage | 353,745 | 314,474 | 445,251 | 569,841 | 235,288 | -59% | 416,793 | 383,720 | 317,159 |

Weighted Average Price PSF | $49.29 | $58.54 | $49.81 | $71.71 | $58.17 | -19% | $59.90 | $57.50 | $64.26 |

Average Building Size | 8,619 | 10,407 | 10,611 | 12,328 | 9,527 | -23% | 10,822 | 10,298 | 10,160 |

Median Building Size | 11,520 | 10,321 | 12,619 | 15,392 | 10,055 | -35% | 12,689 | 11,981 | 11,562 |

Average Land/ Building Ratio | 3.37 | 7.18 | 4.86 | 3.24 | 9.97 | 208% | 6.02 | 5.72 | 5.29 |

Median Land/ Building Ratio | 1.68 | 1.97 | 2.78 | 1.93 | 6.23 | 222% | 3.65 | 2.92 | 2.78 |

Average Transaction Price PSF | $56.06 | $62.19 | $55.23 | $89.27 | $65.30 | -27% | $69.93 | $65.61 | $70.27 |

Median Price Per Square-foot | $46.57 | $56.17 | $52.04 | $60.43 | $58.44 | -3% | $56.97 | $54.73 | $60.17 |

Average Marketing Time | 308 | 433 | 396 | 331 | 529 | 60% | 419 | 400 | 349 |

Median Marketing Time | 259 | 203 | 264 | 169 | 349 | 106% | 261 | 249 | 229 |

Average Ask/ Sell Discount | -16% | -20% | -24% | -15% | -14% | -8% | -18% | -18% | -18% |

Median Ask/ Sell Discount | -13% | -18% | -18% | -12% | -10% | -19% | -13% | -14% | -15% |

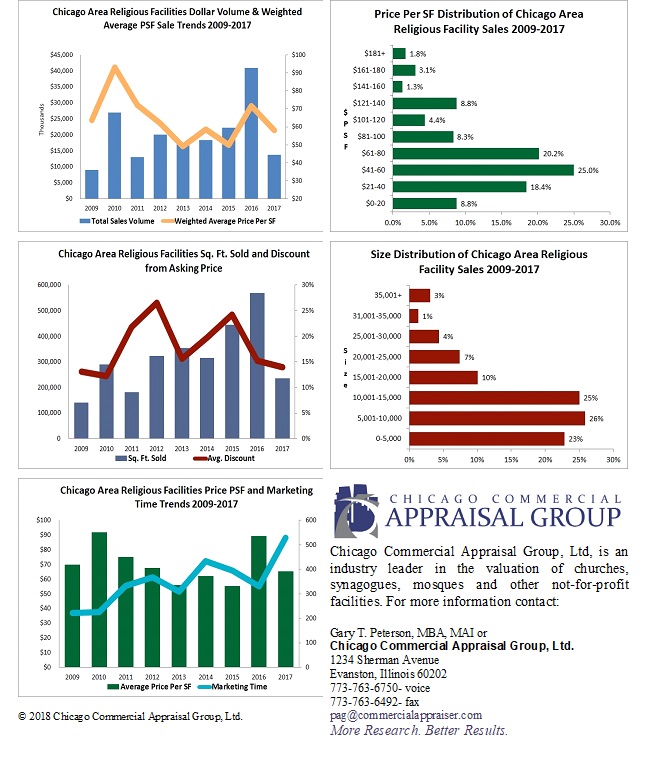

- Challenged by changing worship practices and declining religious participation, the market for religious facilities has largely been bypassed in the tepid economic recovery since the recession. General market statistics over the last 3 to 5 years, compared to the longer run 9-year trend are indistinguishable, with the exception that per square-unit prices have actually fallen! Prices were up in 2016, but this may be due to a number of churches in the north city (Logan Square, Wicker Park areas) that sold for conversion, or redevelopment. These prices were driven by high land values. [1]

- Market activity was off sharply in 2017, with declines in almost every indicator. The only indicator showing improvement was a smaller than average discount between asking price and final sale price.

- There were markedly fewer sales in 2017 compared to 2016, and overall dollar volume fell 67%. In dollar terms, 2017 was 32% below the 9-year average.

- Churches are small. Most sales since 2009 (74%) are under 15,000 square-feet. (The median is 12,291 square-feet). The median size of a religious property sold in 2017 was 13% smaller than the overall median for the last nine years. Notably, the average price per square-foot was down 19% from 2016, and 9.5% below the 9-year average.The average age of a religious facility sold in 2017 was 75 years.

- Most properties (72%) sold for under $80 per square-foot. (The median was $59 per square-foot). Half were priced between $37 and $87 per square-foot. The average discount from the original asking price to the final sales price fell to 14% in 2017, an improvement over the longer-term average of 18%.

- After falling in 2016, average marketing time increased 60% to 17 months in 2017. The average since 2009 has been similar at 18 months.

- Of the 22 sales in 2017, six (27%) were in the city of Chicago vs. the suburbs. This is a shift from past trends which found 46% of sales in the city.